-

-

-

SILVER/ROSE/GOLD

Etch Behold Charm Jessica Urlichs

Regular price From $69.00 - $79.00Sale price From $69.00 - $79.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Etch Empower Charm Jessica Urlichs

Regular price From $59.00 - $69.00Sale price From $59.00 - $69.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Etch Pendant Jessica Urlichs

Regular price From $89.00 - $109.00Sale price From $89.00 - $109.00 Regular priceUnit price per$0.00 -

Personalise MeSILVER/ROSE/GOLD

Behold Heart Locket

Regular price From $99.00 - $109.00Sale price From $99.00 - $109.00 Regular priceUnit price per$0.00Personalise Me -

Personalise MeSILVER/ROSE/GOLD

Behold Heart Locket Necklace

Regular price From $188.00 - $358.00Sale price From $188.00 - $358.00 Regular priceUnit price per$0.00Personalise Me -

Ready to ShipGOLD/SILVER/ROSE

Bevel locket

Regular price From $99.00 - $109.00Sale price From $99.00 - $109.00 Regular priceUnit price perReady to Ship -

Ready to ShipGOLD/SILVER/ROSE

Bevel Locket Necklace

Regular price From $188.00 - $358.00Sale price From $188.00 - $358.00 Regular priceUnit price perReady to Ship -

SILVER/ROSE/GOLD

Heart Pearl Hoop Charm - Set of 2

Regular price From $59.00 - $79.00Sale price From $59.00 - $79.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Heart Pearl Hoops

Regular price From $118.00 - $148.00Sale price From $118.00 - $148.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Heart Pearl Charm

Regular price From $39.00 - $49.00Sale price From $39.00 - $49.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Keshi Pearl Earrings

Regular price From $89.00 - $99.00Sale price From $89.00 - $99.00 Regular priceUnit price per -

SILVER/ROSE/GOLD

Etch Story Locket Jessica Urlichs - Beautiful Chaos

Regular price From $139.00 - $149.00Sale price From $139.00 - $149.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Etch Story Locket Jessica Urlichs - All I see is you

Regular price From $139.00 - $149.00Sale price From $139.00 - $149.00 Regular priceUnit price per$0.00 -

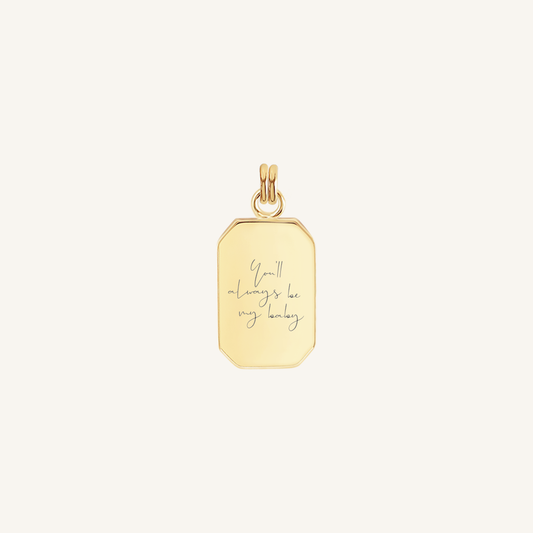

SILVER/ROSE/GOLD

Etch Story Locket Jessica Urlichs - You’ll always be my baby

Regular price From $139.00 - $149.00Sale price From $139.00 - $149.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Jagger Huggies

Regular price From $89.00 - $99.00Sale price From $89.00 - $99.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Boston Hoops

Regular price From $109.00 - $129.00Sale price From $109.00 - $129.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Dune Cuff

Regular price From $99.00 - $129.00Sale price From $99.00 - $129.00 Regular priceUnit price per$0.00 -

SILVER/ROSE/GOLD

Decade Cuff

Regular price From $99.00 - $119.00Sale price From $99.00 - $119.00 Regular priceUnit price per -

Engrave meSILVER/ROSE/GOLD

Etch Chain Necklace 3 Panels

Regular price From $229.00 - $279.00Sale price From $229.00 - $279.00 Regular priceUnit price perEngrave me -

Engrave meSILVER/ROSE/GOLD

Etch Chain Bracelet 3 Panels

Regular price From $159.00 - $189.00Sale price From $159.00 - $189.00 Regular priceUnit price perEngrave me -

Personalise MeSILVER/ROSE/GOLD

Etch Adore Necklace

Regular price From $279.00 - $329.00Sale price From $279.00 - $329.00 Regular priceUnit price per$0.00Personalise Me -

Personalise MeSILVER/ROSE/GOLD

Etch Adore Bracelet

Regular price From $189.00 - $219.00Sale price From $189.00 - $219.00 Regular priceUnit price per$0.00Personalise Me -

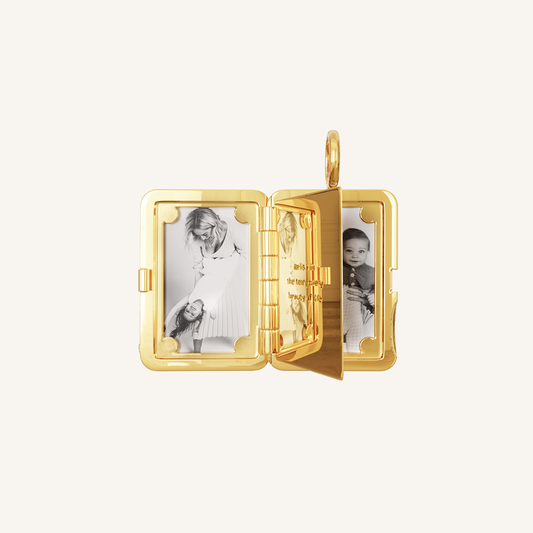

Personalise MeSILVER/ROSE/GOLD

Etch Story Locket

Regular price From $139.00 - $149.00Sale price From $139.00 - $149.00 Regular priceUnit price per$0.00Personalise Me -

Personalise MeSILVER/ROSE/GOLD

Etch Story Locket Necklace

Regular price From $228.00 - $398.00Sale price From $228.00 - $398.00 Regular priceUnit price per$0.00Personalise Me -

Ready to ShipGOLD/SILVER/ROSE

Oval Locket

Regular price From $99.00 - $109.00Sale price From $99.00 - $109.00 Regular priceUnit price perReady to Ship -

Ready to ShipGOLD/SILVER/ROSE

Oval Locket Necklace

Regular price From $188.00 - $358.00Sale price From $188.00 - $358.00 Regular priceUnit price perReady to Ship